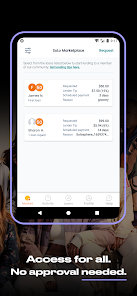

SoLo Funds: Lend & Borrow

Advertisement

100K+

Installs

Solo Funds Inc.

Developer

-

Finance

Category

-

Rated for 3+

Content Rating

-

https://solofunds.com/privacy

Privacy Policy

Advertisement

Screenshots

editor reviews

📱SoLo Funds: Lend & Borrow, crafted by Solo Funds Inc., is a peer-to-peer lending platform that empowers individuals to seek financial assistance or provide support to their peers. 🌐 Its unique community-focused model situates it as an innovative alternative to traditional lending institutions. SoLo Funds stands out for its direct and personable approach to microloans, 💸 where users are connected without the red tape of banks. 🤝 The app's intuitive interface, coupled with its transparent fee structure, makes it a go-to choice for micro-lenders and borrowers alike. 🤳 Users praise its accessibility and the sense of community it fosters, allowing for loans to be personalized and negotiated. Given the app's commitment to creating a trustworthy and supportive environment for financial transactions, it's easy to see why many opt for SoLo Funds over others. 🚀 If you're in need of a quick loan or willing to help others financially, download SoLo Funds and join the micro-financing revolution! ✨

features

- 🔍 User-Centric Design – SoLo Fund's interface is designed with ease of use in mind, presenting a clean, navigable experience for all users.

- 🌟 Transparent Transactions – Every transaction is clear and upfront, ensuring users understand the terms and agreements before any exchange.

- 🔐 Security First – The platform prioritizes user safety with secure data protocols, providing peace of mind for both lenders and borrowers.

pros

- 🙌 Community Trust – SoLo Funds generates a community of trust through user ratings and social verification, instilling confidence in the lending process.

- 🚀 Rapid Lending Process – The app provides a swift mechanism for users to obtain loans, usually in a matter of minutes or hours.

- 💡 Financial Empowerment – Encouraging financial literacy, SoLo Funds offers users a platform to learn and grow their finance management skills.

cons

- 🤔 Limited Scope – As a niche platform for microloans, it may not be suitable for users seeking larger loan amounts or long-term financial solutions.

- 🌐 Geographical Restrictions – The scope of SoLo Funds may be limited by geographical location, restricting access to certain users.

- 💬 Dependent on User Base – The efficiency of the platform is reliant on the active participation of its community, which can fluctuate.

Recommended Apps

![]()

네이버 - NAVER

NAVER Corp.3.7![]()

Unit Converter

Smart Tools co.4.5![]()

Slowly - Make Global Friends

Slowly Communications Ltd.4.6![]()

Allpoint® Mobile

Cardtronics, INC.3.5![]()

Messages

Text Messaging4.1![]()

Meme Soundboard by ZomboDroid

ZomboDroid4.4![]()

Rap To Beats

GizmoJunkie3.7![]()

Blood Pressure & Sugar:Track

HealthTracker Apps4.2![]()

Fandom

Fandom, Incorporated4.5![]()

Flirtini - Chat, Flirt, Date

Xymara LTD3.8![]()

JOANN - Shopping & Crafts

Jo-Ann Stores4![]()

Achievers

Achievers LLC4.5![]()

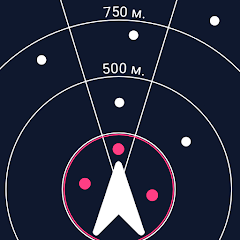

Police Radar - Camera Detector

M.I.R.4![]()

AR Plan 3D Tape Measure, Ruler

Grymala apps4.6![]()

Shop Your Way

Shop Your Way3.5

Hot Apps

-

![]()

UnitedHealthcare

UNITED HEALTHCARE SERVICES, INC.4.4 -

![]()

Netflix

Netflix, Inc.3.9 -

![]()

Instagram

Instagram4.3 -

![]()

My Spectrum

Charter/Spectrum4.6 -

![]()

Zoom - One Platform to Connect

zoom.us4.1 -

![]()

TracFone My Account

TracFone Wireless, Inc.3.6 -

![]()

Fubo: Watch Live TV & Sports

fuboTV1.7 -

![]()

Police Scanner - Live Radio

Police Scanner, Scanner Live Radio App4.8 -

![]()

myAir™ by ResMed

ResMed3 -

![]()

DealDash - Bid & Save Auctions

DealDash.com3.9 -

![]()

Xfinity My Account

Comcast Cable Corporation, LLC3.3 -

![]()

Planet Fitness Workouts

Planet Fitness3.9 -

![]()

Lyft

Lyft, Inc.4 -

![]()

Uber - Request a ride

Uber Technologies, Inc.4.6 -

![]()

Plant Identifier App Plantiary

Blacke4.1 -

![]()

myCigna

Cigna2.9 -

![]()

GameChanger

GameChanger Media4.6 -

![]()

Dofu Live NFL Football & more

DofuSports Ltd4.2 -

![]()

Affirm: Buy now, pay over time

Affirm, Inc4.7 -

![]()

Signal Private Messenger

Signal Foundation4.5 -

![]()

MyChart

Epic Systems Corporation4.6 -

![]()

PlantSnap plant identification

PlantSnap, Inc.3.1 -

![]()

Brigit: Borrow & Build Credit

Brigit4.6 -

![]()

T-Mobile Internet

T-Mobile USA4 -

![]()

MLB Ballpark

MLB Advanced Media, L.P.4.4 -

![]()

Amazon Shopping

Amazon Mobile LLC4.1 -

![]()

Telegram

Telegram FZ-LLC4.2 -

![]()

United Airlines

United Airlines4.6 -

![]()

Google Chat

Google LLC4.4 -

![]()

Newsmax

Newsmax Media4.7

Disclaimer

1.Appinfocenter does not represent any developer, nor is it the developer of any App or game.

2.Appinfocenter provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3.All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4. Appinfocenter abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy .