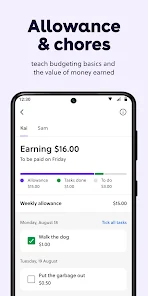

GoHenry: Kids & Teens Banking

Advertisement

1M+

Installs

gohenry Ltd

Developer

-

Finance

Category

-

Rated for 3+

Content Rating

-

https://www.gohenry.com/uk/terms-and-conditions/privacy-policy/

Privacy Policy

Advertisement

Screenshots

editor reviews

🚀 GoHenry, the brainchild of gohenry Ltd, is a pioneering 🌟 banking app designed for kids and teens to learn financial responsibility. Its vibrant interface and engaging toolset stand out in the 🤹♂️ sea of family finance apps, often appealing to parents seeking to instill money-management skills in their offspring. Interactive budgeting features, real-time transaction notifications, and customizable debit cards make GoHenry an educational yet fun platform for youngsters to navigate the financial world 🌍. What sets it apart is its emphasis on financial education 🎓 through practical experience. Compared to similar apps, GoHenry's robust parental controls and educational resources are top-notch. GoHenry is not just a banking tool; it's a learning adventure for families. Hop on board 🛫 and embark on this crucial journey of financial literacy—download GoHenry today and give your children a head start in mastering 💡 their monetary universe! 🏦👨👩👧👦

features

- 🌈 Easy-to-Use Interface: The app boasts a user-friendly environment that simplifies complex financial concepts for kids and teens.

- 🎨 Card Customization: Young users get to personalize their debit cards, making the financial experience more engaging.

- 🛡️ Parental Supervision: Features like spending limits and real-time alerts allow parents to oversee their child’s spending habits effectively.

- 🔗 Educational Content: The app integrates learning directly into its functionality, with materials that guide young users through the basics of finance.

- 📊 Savings Goals: It encourages setting and reaching savings targets, fostering a habit of saving for the future.

pros

- 🎓 Financial Education: GoHenry excels in teaching impactful financial lessons through practical use.

- 👪 Family Collaboration: It creates opportunities for discussions on money management within the family.

- 🔐 Security Measures: With features like instant card blocking, the app assures parents peace of mind for their children’s financial safety.

cons

- 🤑 Subscription Fee: There is a monthly charge, which may be a consideration for budget-conscious families.

- 🌐 Limited Reach: The service is not available in all countries, limiting its accessibility for some interested users.

- 📱 Device Compatibility: The experience may vary depending on the device, with some features not fully optimized for all platforms.

Recommended Apps

![]()

네이버 - NAVER

NAVER Corp.3.7![]()

Unit Converter

Smart Tools co.4.5![]()

Slowly - Make Global Friends

Slowly Communications Ltd.4.6![]()

Allpoint® Mobile

Cardtronics, INC.3.5![]()

Messages

Text Messaging4.1![]()

Meme Soundboard by ZomboDroid

ZomboDroid4.4![]()

Rap To Beats

GizmoJunkie3.7![]()

Blood Pressure & Sugar:Track

HealthTracker Apps4.2![]()

Fandom

Fandom, Incorporated4.5![]()

Flirtini - Chat, Flirt, Date

Xymara LTD3.8![]()

JOANN - Shopping & Crafts

Jo-Ann Stores4![]()

Achievers

Achievers LLC4.5![]()

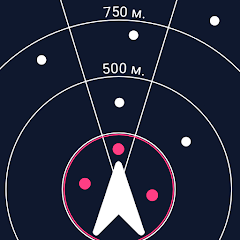

Police Radar - Camera Detector

M.I.R.4![]()

AR Plan 3D Tape Measure, Ruler

Grymala apps4.6![]()

Shop Your Way

Shop Your Way3.5

Hot Apps

-

![]()

UnitedHealthcare

UNITED HEALTHCARE SERVICES, INC.4.4 -

![]()

Netflix

Netflix, Inc.3.9 -

![]()

Instagram

Instagram4.3 -

![]()

My Spectrum

Charter/Spectrum4.6 -

![]()

Zoom - One Platform to Connect

zoom.us4.1 -

![]()

TracFone My Account

TracFone Wireless, Inc.3.6 -

![]()

Fubo: Watch Live TV & Sports

fuboTV1.7 -

![]()

Police Scanner - Live Radio

Police Scanner, Scanner Live Radio App4.8 -

![]()

myAir™ by ResMed

ResMed3 -

![]()

DealDash - Bid & Save Auctions

DealDash.com3.9 -

![]()

Xfinity My Account

Comcast Cable Corporation, LLC3.3 -

![]()

Planet Fitness Workouts

Planet Fitness3.9 -

![]()

Lyft

Lyft, Inc.4 -

![]()

Uber - Request a ride

Uber Technologies, Inc.4.6 -

![]()

Plant Identifier App Plantiary

Blacke4.1 -

![]()

myCigna

Cigna2.9 -

![]()

GameChanger

GameChanger Media4.6 -

![]()

Dofu Live NFL Football & more

DofuSports Ltd4.2 -

![]()

Affirm: Buy now, pay over time

Affirm, Inc4.7 -

![]()

Signal Private Messenger

Signal Foundation4.5 -

![]()

MyChart

Epic Systems Corporation4.6 -

![]()

PlantSnap plant identification

PlantSnap, Inc.3.1 -

![]()

Brigit: Borrow & Build Credit

Brigit4.6 -

![]()

T-Mobile Internet

T-Mobile USA4 -

![]()

MLB Ballpark

MLB Advanced Media, L.P.4.4 -

![]()

Amazon Shopping

Amazon Mobile LLC4.1 -

![]()

Telegram

Telegram FZ-LLC4.2 -

![]()

United Airlines

United Airlines4.6 -

![]()

Google Chat

Google LLC4.4 -

![]()

Newsmax

Newsmax Media4.7

Disclaimer

1.Appinfocenter does not represent any developer, nor is it the developer of any App or game.

2.Appinfocenter provide custom reviews of Apps written by our own reviewers, and detailed information of these Apps, such as developer contacts, ratings and screenshots.

3.All trademarks, registered trademarks, product names and company names or logos appearing on the site are the property of their respective owners.

4. Appinfocenter abides by the federal Digital Millennium Copyright Act (DMCA) by responding to notices of alleged infringement that complies with the DMCA and other applicable laws.

5.If you are the owner or copyright representative and want to delete your information, please contact us [email protected].

6.All the information on this website is strictly observed all the terms and conditions of Google Ads Advertising policies and Google Unwanted Software policy .